UK MPs Approve Major Online Gambling Tax Hike Despite Gibraltar Warnings

Lawmakers in Westminster are having an impact on Gibraltar. (Image: Alan Evans/Casinos.com)

UK lawmakers on Tuesday passed changes to online gambling taxes as part of the Finance Bill with no opposition, moving forward with a significant increase in duty that the Government says will generate roughly £1 billion a year for public finances.

The increases, including nearly doubling the remote gaming duty from 21 percent to 40 percent from 1 April 2026, were first announced in Chancellor Rachel Reeves’s 2025 Budget and are designed to modernise gambling taxation as the market shifts increasingly online.

But the debate in the House of Commons exposed deep concerns about the broader economic impact of the reform, particularly on Gibraltar, which hosts many UK facing online gambling companies.

Gibraltar’s Economy and Parliamentary Concerns

Gibraltar’s Government has repeatedly warned that the tax rises would disproportionately affect its economy, where betting and gaming firms contribute about 30 percent of GDP and employ around 3,500 people, more than 10 percent of the workforce.

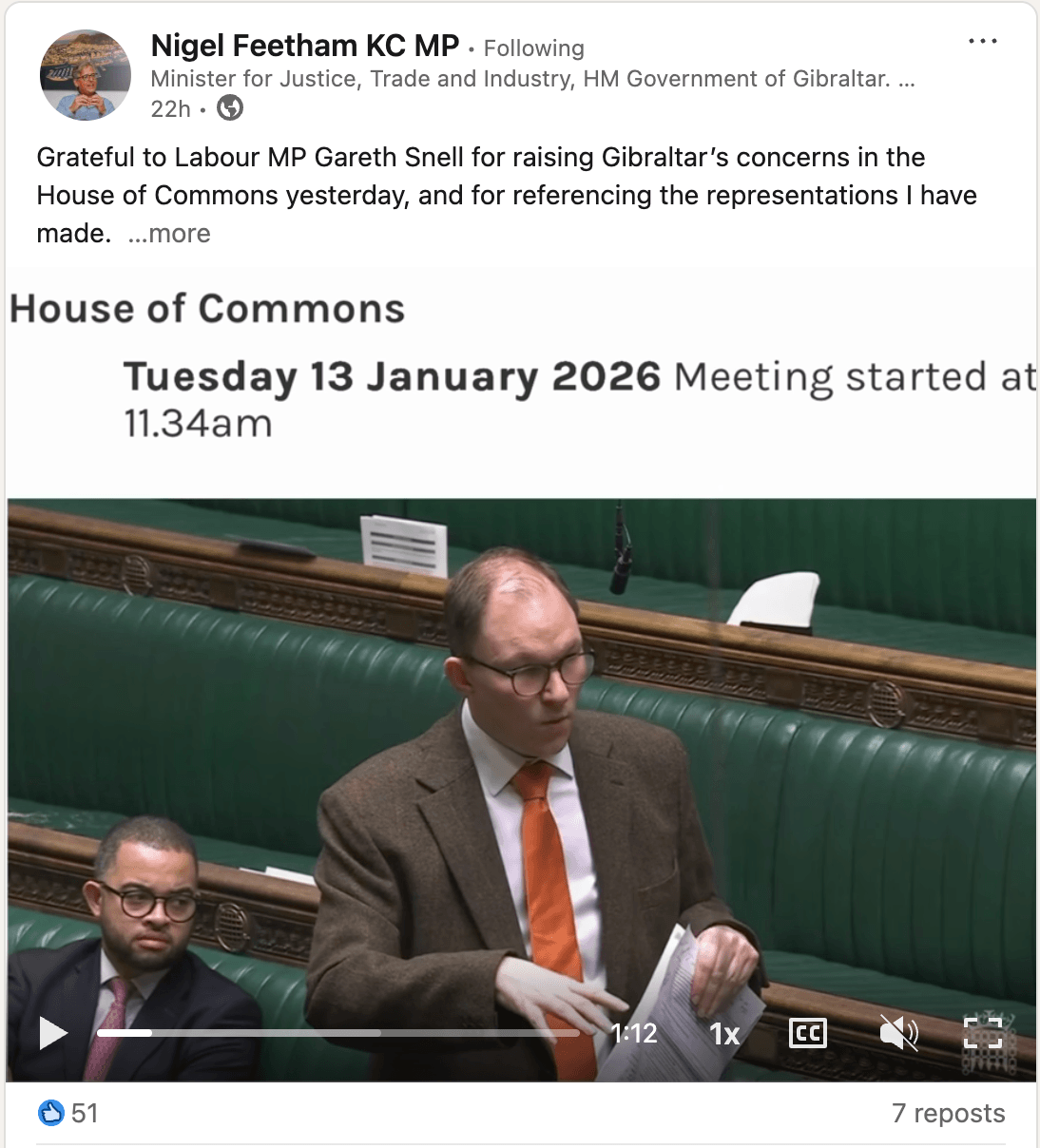

Gareth Snell MP asked questions in Parliament. (Image: Nigel Feetham/Linkedin)

Labour MP Gareth Snell, echoing those worries during the Finance Bill’s committee stage, said changes “will have an effect” on the overseas territory and pressed the Economic Secretary to the Treasury, Lucy Rigby, on what plans the UK Government has to address any resulting budget shortfalls in Gibraltar.

“Nigel Feetham, the Minister for Justice, Trade and Industry in Gibraltar, has repeatedly pointed out that 3,500 people … derive their job from the gambling sector,” Snell told the Commons.

He added that the sector accounts for “30 percent of GDP there” and that the change “will remove tens of millions of pounds from the Government of Gibraltar’s budget.”

Nigel Feetham has raised concerns with UK Government. (Image: Nigel Feetham KC MP)

Snell asked whether ministers had discussed contingency plans in case the reforms inadvertently create “a massive black hole” in Gibraltar’s public finances.

Ms Rigby responded that the UK Government would “monitor” the impact and has been engaging with Gibraltar officials, though she did not outline specific mitigation measures. She stressed the broader regulatory goal of discouraging harmful forms of gambling.

Gibraltar’s Justice Minister, Nigel Feetham KC MP, welcomed that MPs had aired concerns but said his territory would continue to engage constructively with UK counterparts as the changes take effect.

UK Government Rationale and Wider Industry Concerns

The Government describes the tax changes as “targeted,” aiming to raise revenue from remote gambling, a growing sector that saw sustained online activity post pandemic, and to encourage less harmful betting behaviour.

Under the reforms:

• Remote Gaming Duty, covering online casino games, slots, and bingo, rises from 21 percent to 40 percent from April 2026.

• A new remote betting duty of 25 percent will apply from April 2027 to online sports betting profits, replacing the current 15 percent rate.

• Bingo duty will be abolished from April 2026.

Supporters of the tax rise in Parliament say the changes will generate substantial additional revenue for public services without altering the tax treatment of in person gambling or horse racing.

But MPs from across parties warned of potential unintended consequences:

• Job losses: Snell said his constituency, home to major online bookmaker Bet365, could see employment cuts or relocations.

• Unregulated markets: Conservative former minister Sir Gavin Williamson and Dame Caroline Dineage of the Culture, Media and Sport Committee voiced fears that higher costs could push consumers toward unlicensed “black market” operators unbound by safeguards like deposit limits or financial vulnerability checks.

• Revenue stability doubts: Conservative shadow Treasury minister James Wild said it was “questionable” whether the measures would deliver long term, stable revenue gains.

In response to some of these concerns, the Government has pledged an additional £26 million in funding for the UK Gambling Commission over the next three years to boost enforcement against illegal operators.

What’s Next

The Finance Bill still needs to complete its remaining stages in the Commons and be reviewed in the House of Lords before becoming law.

The reforms mark one of the most significant overhauls of UK gambling taxation in years, reflecting broader debates about how to balance public health goals, fiscal priorities, and economic impacts on sectors tied to offshore jurisdictions. Gibraltar’s strong warning highlights the real world economic links between UK policy and overseas territories that host key parts of regulated industries.

Meet The Author

Experience

Most of my career was spent in teaching including at one of the UK’s top private schools. I left London in 2000 and set up home in Wales raising four beautiful children. I enrolled at University where I studied Photography and film and gained a Degree and subsequently a Masters Degree. In 2014 I helped launch a new local newspaper and managed to get front and back page as well as 6 filler pages on a weekly basis. I saw that journalism was changing and was a pioneer of hyperlocal news in Wales. In 2017 I started one of the first 24/7 free independent news sites for Wales. Having taken that to a successful business model I was keen for a new challenge. Joining the company is exciting for me especially as it is a new role in Europe. I am keen to establish myself and help others to do the same.

Read Full BioRelated News