People try Grab Poker, a skill-based gaming machine, at the Gamblit booth during the Global Gaming Expo in Las Vegas. (Image: Associated Press)

The UK’s regulated gambling market is growing fast, but skills-based gambling fans won’t find a clear line item for it in the data.

Across the pond and in Asia, the numbers are louder. But in Britain, growth is hiding in plain sight.

The UK’s Gambling Commission recently reported that the total gross gambling yield (GGY) across Great Britain hit £16.8 billion for the period April 2024 to March 2025. That’s a 7.3% jump year-on-year, and a strong sign the market is bouncing back. The biggest driver? Remote gambling.

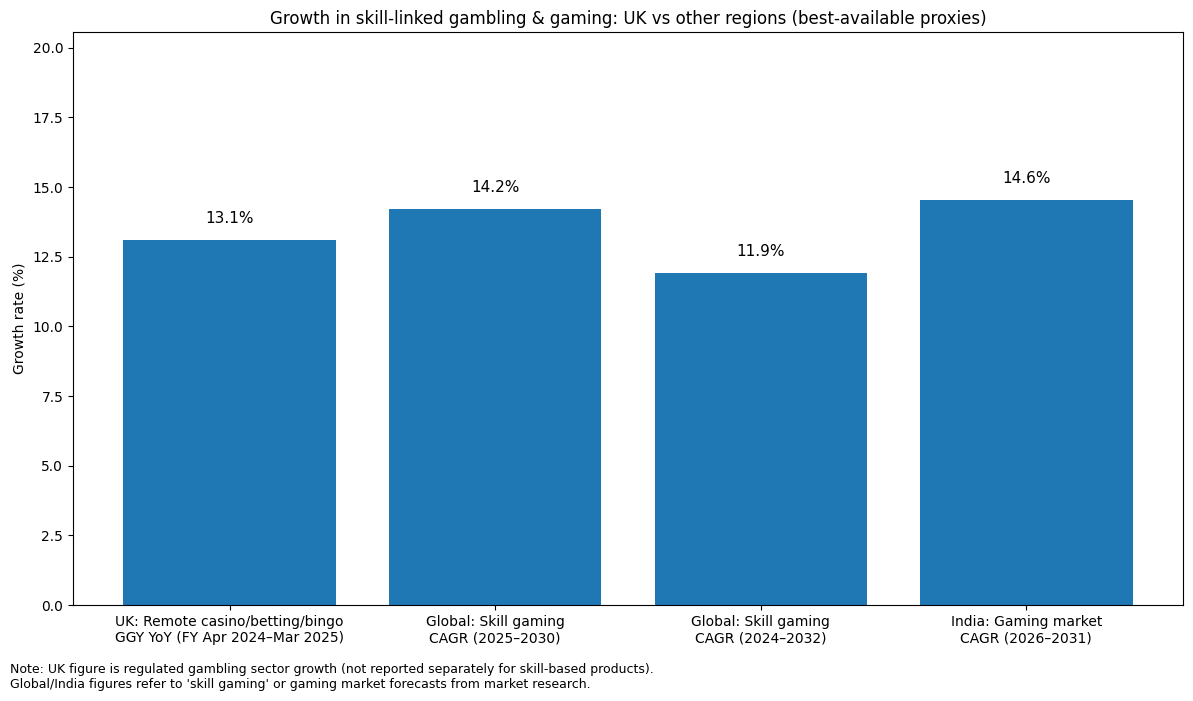

Online Casino, Betting and Bingo (RCBB) accounted for £7.8 billion of that total, up 13.1% year-on-year, making it the strongest performing sector. But despite this online boom, those looking for a skills-based gambling breakout won’t find it. The regulator doesn’t categorise or report “skill gaming” separately.

That doesn’t mean the segment isn’t growing, it just means it’s invisible.

Remote Growth Signals Hidden Momentum

In the UK, skills-based formats, such as strategy-driven games, social competition, and wagering hybrids, are typically delivered online. So, it stands to reason that RCBB is where this growth lives. Even if regulators aren’t naming it, players are clearly spending more time and money in the spaces where these games thrive: apps and online platforms.

Across Europe, the trend holds. The European Gaming and Betting Association (EGBA) projects online betting and gaming will generate €47.9 billion in 2024, accounting for 38.8% of the continent’s total gross gambling revenue. That’s a strong sign the UK’s shift to digital is part of a broader transformation across the region.

Clearer Skill Gaming Categories in North America

Meanwhile, in the US, skills-based gambling isn’t just growing, it’s being measured and marketed as its own category. This includes real-money competitive games, digital tournaments, and formats where player skill directly affects outcomes.

According to Grand View Research, the global skill gaming market is worth $40.85 billion in 2024 and is expected to more than double to $92.03 billion by 2030, with North America holding a 23% market share this year. Fortune Business Insights offers a slightly higher 2024 valuation of $40.69 billion and pegs the North American market share at 27.77%. Both firms see strong compound annual growth rates above 11%.

Asia Shows Big Potential, But Big Risk

In Asia, the growth narrative is harder to pin down. India’s gaming market alone is projected to reach $4.38 billion by 2025, with a 14.55% compound annual growth rate from 2026 to 2031, according to Mordor Intelligence.

But regulatory shifts can throw growth off course overnight. In early 2025, Flutter Entertainment shut down its real-money gaming operations in India after new legislation banned games played with money online. Reuters reported the crackdown underscored how fragile the “skill vs. chance” legal distinction can be in markets where definitions vary by state or region.

Definitions, and Data, Still Matter

The global takeaway? Skills-based gambling is growing, but whether and how that’s recognised depends on local reporting standards.

In the UK, the growth is real, remote revenues are soaring, but the lack of category clarity means skills-based formats remain hidden in aggregated stats. Operators know it’s happening. Analysts know it’s happening. But unless reporting standards change, the numbers will never show it outright.

Contrast that with North America, where skill gaming is increasingly seen as a standalone commercial category. Or Asia, where growth potential is explosive but policy reversals can kill a market overnight.

For operators, the question isn’t just where the growth is, but how it’s counted. And for regulators and policymakers, the challenge is keeping up with evolving definitions of what gambling is, especially as games become more interactive, competitive and app-driven.

Read the UK Gambling Commission GGY 2024–25: Gambling Commission Official Stats.

Meet The Author

Experience

Most of my career was spent in teaching including at one of the UK’s top private schools. I left London in 2000 and set up home in Wales raising four beautiful children. I enrolled at University where I studied Photography and film and gained a Degree and subsequently a Masters Degree. In 2014 I helped launch a new local newspaper and managed to get front and back page as well as 6 filler pages on a weekly basis. I saw that journalism was changing and was a pioneer of hyperlocal news in Wales. In 2017 I started one of the first 24/7 free independent news sites for Wales. Having taken that to a successful business model I was keen for a new challenge. Joining the company is exciting for me especially as it is a new role in Europe. I am keen to establish myself and help others to do the same.

Read Full BioRelated News