UK Gambling Market Proves Resilient as Regulated Online Growth Offsets Retail Pressures

Steady regulated growth in the UK. (Image: Imagegallery2/Alamy)

The UK gambling market is showing signs of long-term resilience rather than volatility, with steady regulated online growth helping to offset ongoing structural pressures in the retail sector.

Latest figures from the UK Gambling Commission put total gross gambling yield (GGY) at £16.8bn, broadly flat year-on-year. While this would once have been framed as stagnation, industry analysts increasingly view the performance as evidence that the UK has entered a more mature, predictable phase following years of regulatory change.

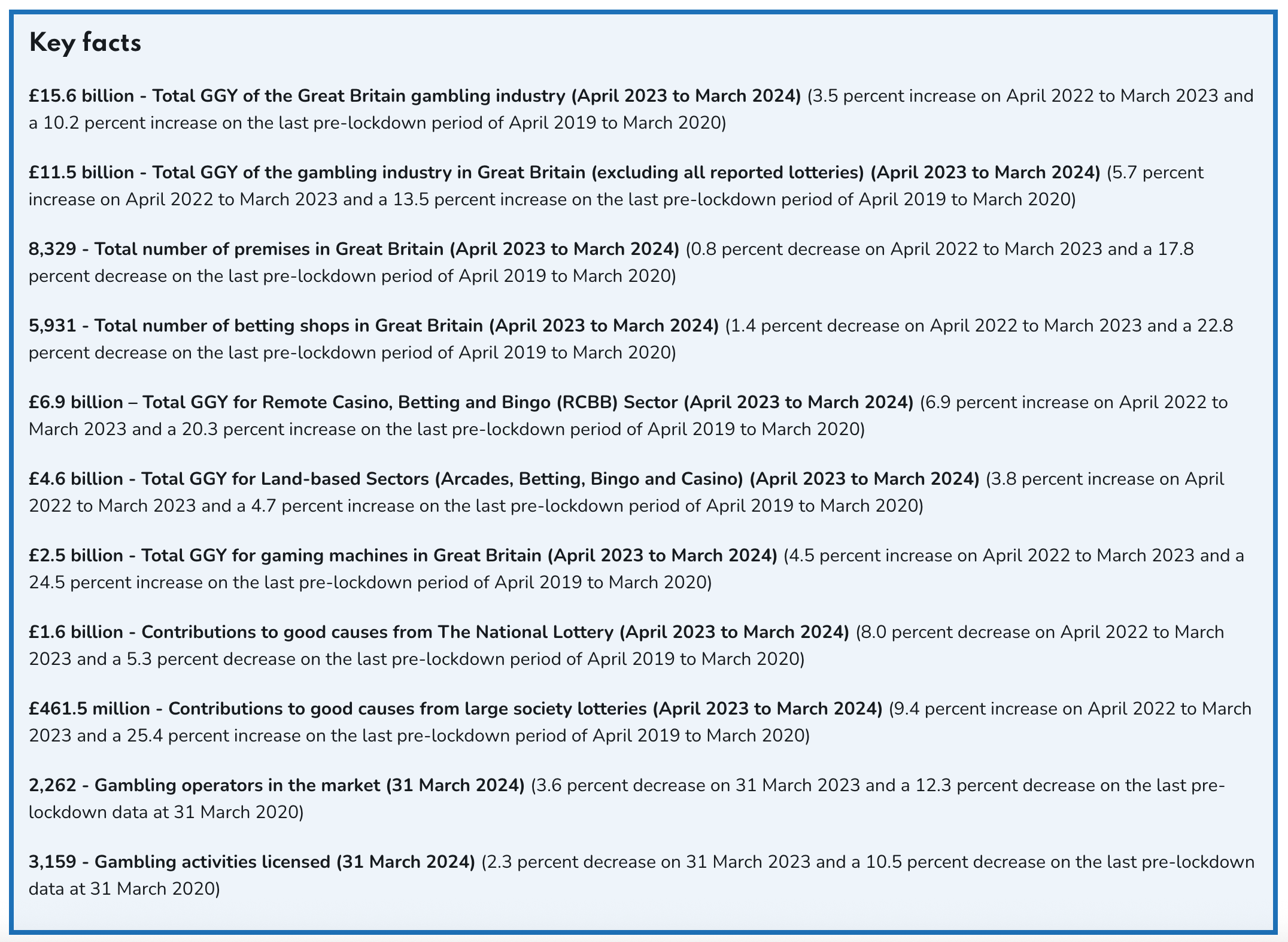

Key Facts from the UK Gambling Commission. (Image: UK Gambling Commission)

Stability, Not Spikes, is the New Signal

Rather than chasing headline growth rates, the more meaningful story lies in how market volatility has reduced over time.

Over the past decade, total GGY has followed a narrow, upward-to-flat range, with short-term shocks, including Covid and post-White Paper reforms, absorbed without lasting damage. The result is a market that appears less reactive and more structurally stable than many European peers.

Online Growth Offsets Land-Based Decline

The composition of UK gambling revenue continues to evolve, but at a measured pace.

Online gambling now accounts for just over 60% of total GGY, a share that has stabilised rather than surged in recent years. This has helped cushion the decline in land-based revenue from betting shops and casinos, which remain under pressure from higher costs, changing consumer habits and tighter operating conditions.

Within the online segment, online casinos continue to account for the largest share of digital revenue, benefiting from scale, product maturity and a regulatory framework that has prioritised consumer protections alongside commercial sustainability.

Importantly, the online channel’s growth has occurred within a well-defined regulatory framework, reinforcing the UK’s status as one of the world’s most controlled, and investable, gambling jurisdictions.

A Calmer Market Post-White Paper

The recalibration following the Gambling Act White Paper is increasingly visible in the data. Instead of sharp swings driven by regulatory uncertainty, operators are adjusting to a clearer set of rules around affordability, marketing and product design.

For investors and policymakers alike, this lower volatility may prove more attractive than rapid growth. Compared with newer or less regulated European markets, the UK now stands out for its predictability, even as absolute growth moderates.

Stability Rather Than Expansion?

As global gambling markets reassess risk in a higher-interest, compliance-heavy environment, the UK’s ability to maintain steady GGY under tight regulation is becoming the story in its own right.

Stability, rather than expansion, may ultimately be the UK gambling market’s strongest asset.

Meet The Author

Experience

Most of my career was spent in teaching including at one of the UK’s top private schools. I left London in 2000 and set up home in Wales raising four beautiful children. I enrolled at University where I studied Photography and film and gained a Degree and subsequently a Masters Degree. In 2014 I helped launch a new local newspaper and managed to get front and back page as well as 6 filler pages on a weekly basis. I saw that journalism was changing and was a pioneer of hyperlocal news in Wales. In 2017 I started one of the first 24/7 free independent news sites for Wales. Having taken that to a successful business model I was keen for a new challenge. Joining the company is exciting for me especially as it is a new role in Europe. I am keen to establish myself and help others to do the same.

Read Full BioRelated News