Inside the Criminal Network Linking UK Cash, Crypto Laundering and Russian State Interests

NCA launched a massive investigation crossing borders. (Image: NCA)

The National Crime Agency has exposed a billion-dollar money-laundering network that moved criminal cash across the UK before converting it into cryptocurrency used to evade sanctions and support Russian state interests. The same blind spots exploited by the network are the ones launderers have historically targeted within high-cash environments, including licensed casinos, which remain a recurring pressure point for UK regulators.

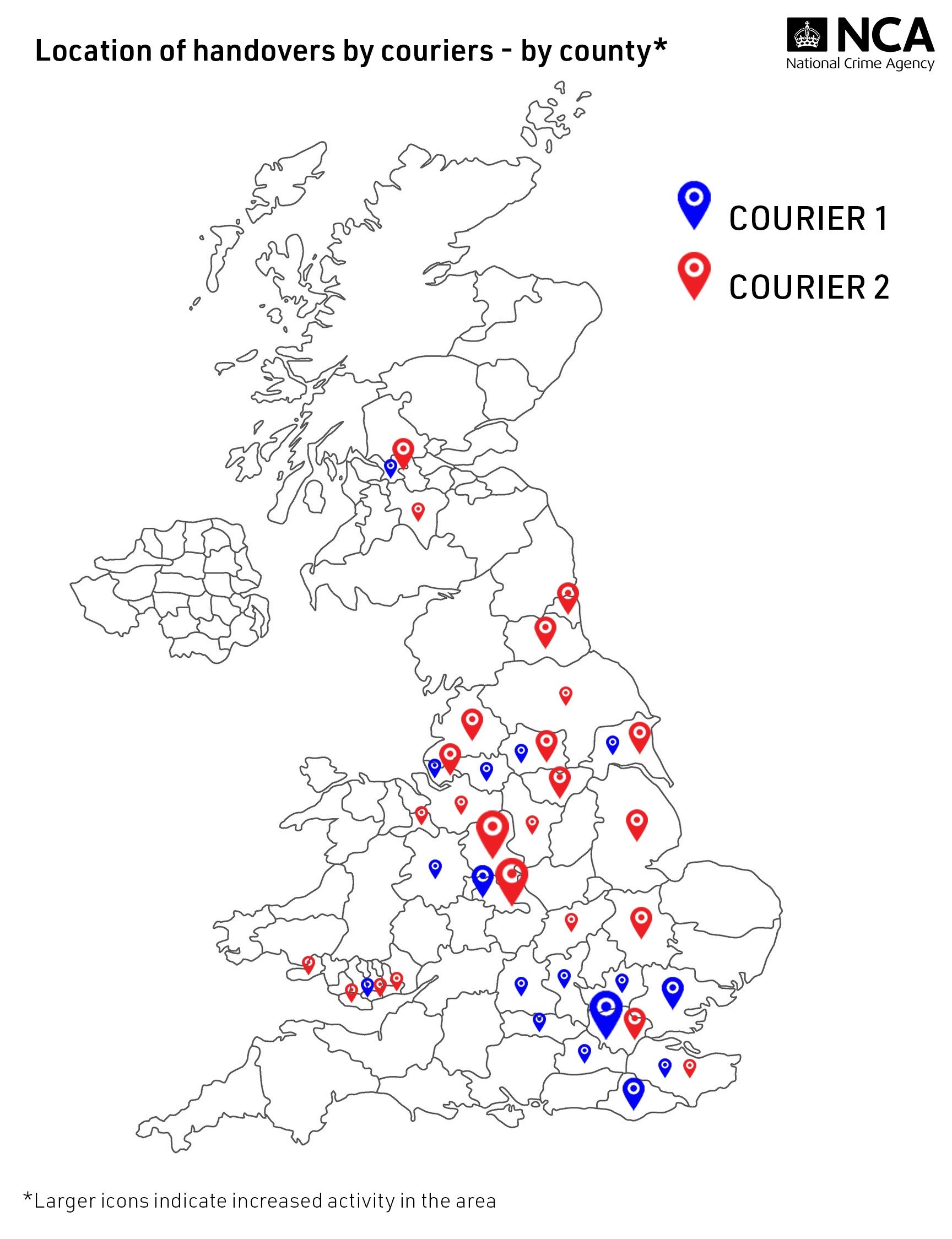

Crime Gangs Operated Across 28 UK Towns and Cities

Operation Destabilise identified couriers working in at least 28 UK towns and cities collecting cash generated from the drugs trade, firearms supply and organised immigration crime. That money was fed into crypto-conversion schemes that helped criminals bypass financial controls. While the NCA has not alleged wrongdoing by UK casino destinations, the findings highlight how easily illicit funds can attempt to pass through gambling venues, despite the UK’s strict anti-money-laundering framework.

Almost 50 UK locations were targeted. (Image: NCA)

The discovery that the network purchased a controlling stake in a Kyrgyz bank to facilitate sanctions-busting payments underscores the scale of the operation. It also signals increased compliance pressure ahead for UK gambling operators, who are already required to flag suspicious cash transactions, verify sources of funds and prevent criminals from using casino floors or online accounts to disguise illicit money.

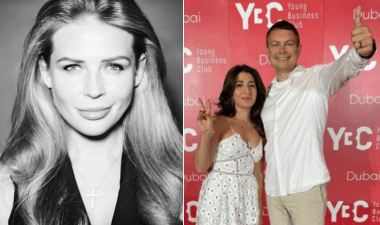

The Networks Behind the Laundering

According to the NCA, two Russian-speaking networks known as Smart and TGR handled the global laundering structure. Smart was run by Ekaterina Zhdanova with support from Khadzi-Murat Magomedov and Nikita Krasnov. TGR was headed by George Rossi, Elena Chirkinyan and Andrejs Bradens.

Ekaterina Zhdanova, George Rossi & Elena Chirkinyan. (Image: NCA)

The groups laundered proceeds from cybercrime, drug trafficking and firearms smuggling, and they also helped their Russian clients evade sanctions to invest in the UK. In summer 2023, individuals linked to the Russian intelligence services attempted to use Smart to fund operatives in Europe, including a UK-based group of Bulgarian nationals later convicted for spying on Russia’s behalf.

All six senior members of Smart and TGR were sanctioned by the US Office of Foreign Assets Control last December. The UK has also sanctioned Altair Holding SA, a company linked to Rossi. Altair owned 75 percent of Keremet Bank in Kyrgyzstan, which investigators say was used to process cross-border payments for Promsvyazbank, a Russian state-owned institution supporting companies involved in the military-industrial base. Zhdanova is currently held in pre-trial detention in France.

How Cash Became Crypto

At the street level, the laundering system depended on couriers who moved cash between UK criminal groups and crypto exchanges. For a small fee, couriers travelled the country collecting bundles of illicit money and delivering them to handlers who converted it into cryptocurrency.

Deputy Director for Economic Crime at the NCA, Sal Melki, said:

“Today we can reveal the sheer scale at which these networks operate and draw a line between crimes in our communities, sophisticated organised criminals and state sponsored activity.”

He added:

“Cash couriers play an intrinsic role in this global money laundering scheme. They are in our communities and making the criminal ecosystem function.”

The NCA’s recent campaign, which displays messages in English and Russian at service stations, aims to warn couriers that their employers make vast profits while they face long prison sentences.

Criminal Cases Emerging From the Network

Several prosecutions illustrate how laundering activities were run. In April, two men received a combined 13-year sentence after laundering six million pounds by purchasing vehicles in the UK, exporting them to Ukraine and converting the profits into cryptocurrency. They admitted collecting cash from Semen Kuksov, who was previously jailed and had been taking direction from Smart Group’s Krasnov.

One month earlier, courier Giorgi Tabatadze was sentenced to three years after 2.2 million pounds passed through his hands. He was arrested in April 2024, with more than 750,000 pounds seized from his car and home.

The NCA states that the heightened risk created by Operation Destabilise forced laundering networks in London to increase their commission rates last summer. Criminal groups were reportedly reluctant to operate in the capital because of the possibility of arrest. Investigators say that access to the legitimate banking sector has also been significantly restricted.

Why It Matters for UK Casinos

Although casinos are heavily regulated, they remain attractive targets for money launderers. High volumes of cash, access to rapid currency exchanges and the ability to turn chips or small winnings into seemingly legitimate funds make them a persistent focus for criminals.

Operation Destabilise shows that millions in street-level cash were circulating through areas where licensed casinos operate. Even when casinos reject suspicious transactions, attempts alone can trigger regulatory concerns. The UK Gambling Commission’s recent enforcement actions underline that operators must identify and report any signs of illicit finance, no matter how small.

As a result of this investigation, operators should expect stricter oversight of high-value cash buy-ins, more detailed source-of-funds checks, enhanced due-diligence expectations and closer examination of accounts flagged for unusual activity. Banks may also introduce additional checks for gambling-related transactions, particularly where customers have a history of offshore or crypto-based payments.

For players, the impact may be subtle. More ID checks, slower withdrawals and careful monitoring of high-spend activity are likely. For operators, however, the risk is substantial. The UKGC has issued more than 100 million pounds in AML penalties across the past decade, and the findings of Operation Destabilise will heighten expectations.

International Pressure and State-Level Risks

The laundering structures linked to Operation Destabilise spread across Europe, Central Asia and the United States. Oligarch Ilan Shor, involved in a related sanctions-evasion scheme, had previously been arrested in 2014 for the theft of one billion dollars from Moldovan banks. European authorities say Shor engaged in political interference on Russia’s behalf. Companies linked to him launched the A7A5 token, marketed as the first rouble-backed stablecoin, before being sanctioned by both the UK and EU.

Security Minister Dan Jarvis said:

“This complex operation has exposed the corrupt tactics Russia used to avoid sanctions and fund its illegal war in Ukraine.”

He added:

“I want to thank every officer for their work uncovering this criminality and intercepting the dirty money networks that bankroll serious organised crime.”

Law enforcement agencies in Ireland, France, Spain, Finland and the United States worked with the NCA throughout the investigation.

The Fight Ahead

Will Lyne, Head of Economic and Cybercrime at the Metropolitan Police, said:

“Our message is clear. There is no safe haven for those that launder money from serious crime.”

Assistant Commissioner Angela Willis of An Garda Síochána echoed that sentiment, emphasising that transnational organised crime threatens communities across Ireland, the UK and Europe.

The NCA says it has already restricted the networks’ ability to operate, but warns that similar structures remain active. With more arrests expected and further assets likely to be seized, investigators are focused on long-term disruption rather than short-term gains.

Case Demonstrates How Money Crosses Borders

Operation Destabilise exposes a laundering network that connects everyday criminality in the UK with oligarchs, cyber-criminals and Russian state-linked interests. It demonstrates how illicit money moves across borders and how quickly legitimate sectors, including casinos, can face collateral pressure when criminal networks attempt to exploit financial systems. As the NCA continues its investigation, the UK gambling sector should prepare for increased regulatory scrutiny, while players may see more robust checks designed to stop criminal finance at the door.

Meet The Author

Experience

Most of my career was spent in teaching including at one of the UK’s top private schools. I left London in 2000 and set up home in Wales raising four beautiful children. I enrolled at University where I studied Photography and film and gained a Degree and subsequently a Masters Degree. In 2014 I helped launch a new local newspaper and managed to get front and back page as well as 6 filler pages on a weekly basis. I saw that journalism was changing and was a pioneer of hyperlocal news in Wales. In 2017 I started one of the first 24/7 free independent news sites for Wales. Having taken that to a successful business model I was keen for a new challenge. Joining the company is exciting for me especially as it is a new role in Europe. I am keen to establish myself and help others to do the same.

Read Full BioRelated News