Gambling compliance maturing. (Image: Ilie Adrian/Alamy)

UK gambling compliance has entered a “professional era”, and the data suggests the market is maturing, not shrinking. A step-change in monitoring, reporting and internal controls is starting to show up in enforcement patterns: more regulatory activity overall, but lower total penalties, a sign that operators are learning the rules faster and fixing problems earlier.

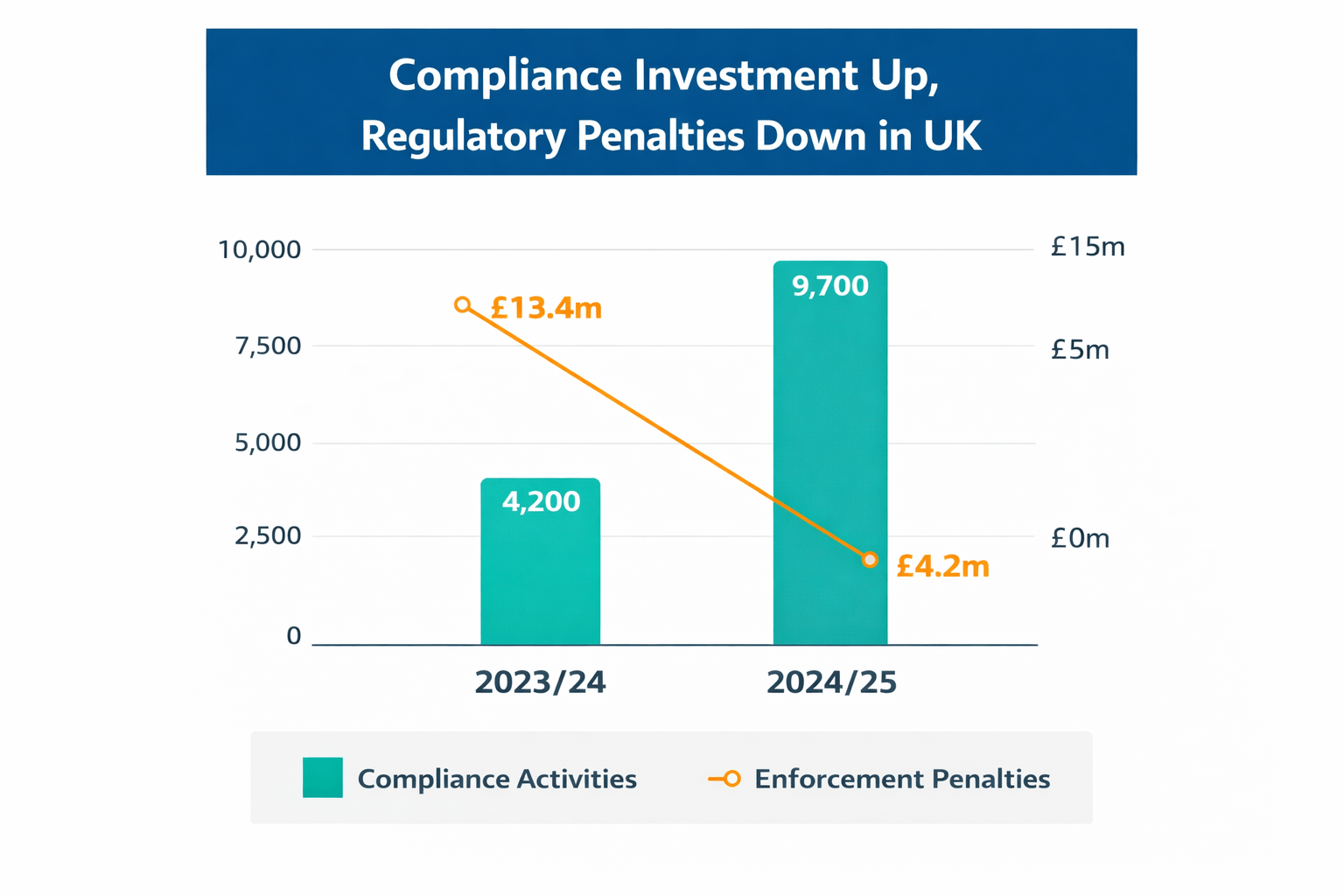

In its 2024/25 Annual Report and Accounts, the UK Gambling Commission says it carried out over 9,700 compliance activities, up from over 4,200 the year before, and took enforcement action against 24 operators, resulting in £4.2m in fines or regulatory settlements. The Commission adds that the reduction in penalties versus the prior year may be a “potentially positive indicator” of rising compliance standards.

Compare that with the Commission’s 2023/24 Annual Report, which noted enforcement action linked to AML, social responsibility controls and customer interaction, with more than £13.4m paid in fines and regulatory settlements by eight operators.

Enforcement as a Learning Curve, not a Guillotine

It’s easy to read enforcement headlines as a sign of a hostile environment. But a better framing is that UK regulation is behaving like a mature safety system: it gets stricter, clearer, and more transparent, and the industry responds by building real compliance capability.

A concrete example is how the regulator now publishes a public register of regulatory actions for the last three years, making enforcement themes (and repeated failings) far easier to spot.

That transparency pushes operators towards a more “institutional” model of compliance: documented processes, accountable owners, auditable controls, and tooling that scales across brands, products and customer cohorts.

What Enforcement is Actually Flagging: AML, Safer Gambling, and Marketing

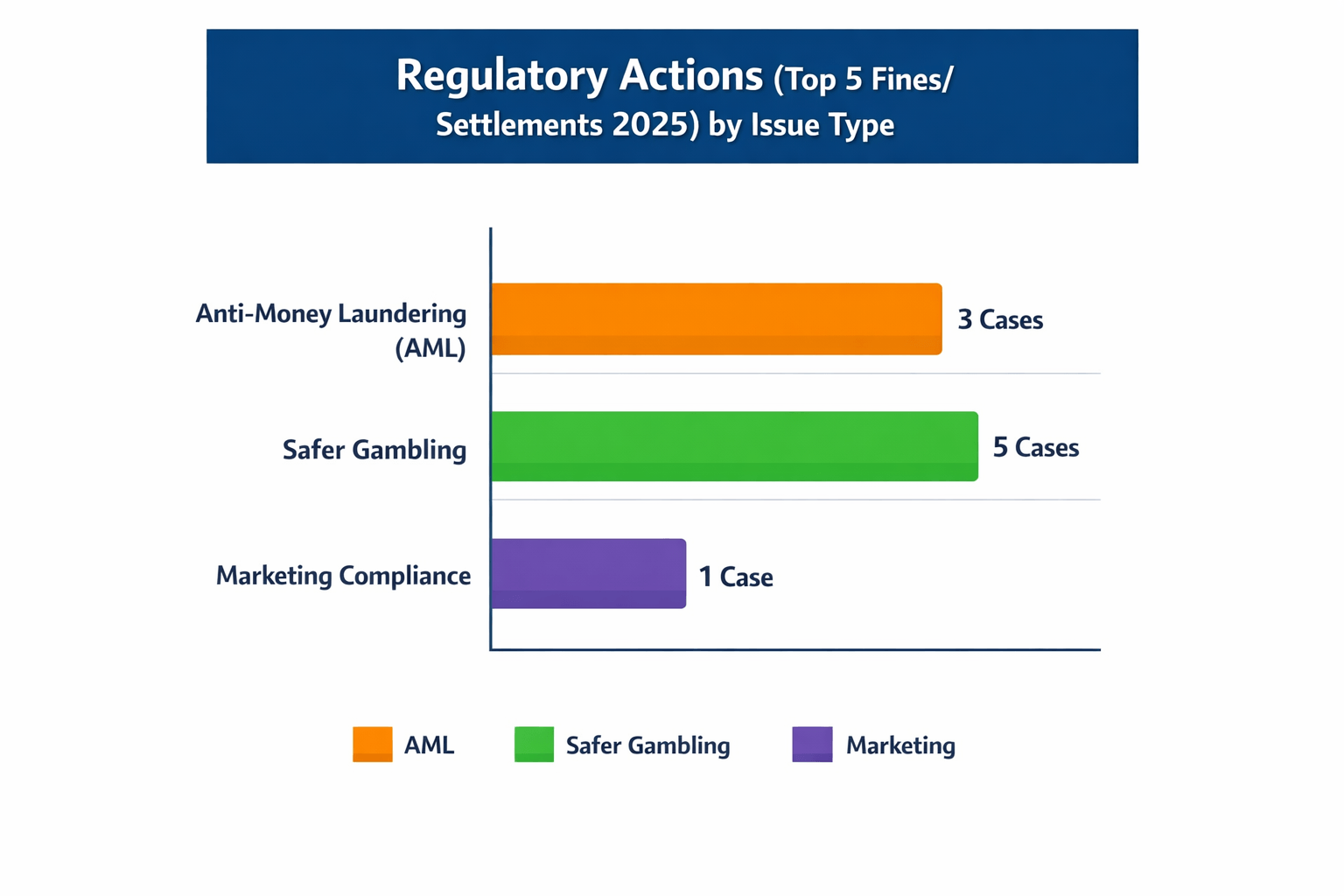

Looking at major enforcement cases in 2025, the same themes recur, but the underlying story is professionalisation: more specific rule references, more consistent remedies (warnings, licence conditions, third-party audits), and clearer expectations around monitoring and intervention.

A snapshot from the Gambling Commission’s regulatory action register illustrates the typical mix:

Importantly, the actions also show something else: remediation is now part of the standard enforcement shape. Operators are routinely described as cooperating and taking steps to remedy issues, which is what you’d expect in a maturing market where compliance is becoming operationalised rather than improvised.

Repeat Failings: Still Visible, but Harder to Hide

Repeat enforcement hasn’t vanished, but it’s increasingly detectable and therefore costly from a governance perspective. The combination of public registers, sharper LCCP references, and more frequent compliance activity means repeat patterns are less likely to slip through the cracks.

Even where the regulator notes “human error” in applying existing policies, it’s still treated as a breach, a reminder that “having a policy” is no longer a defence; evidence of execution is what matters.

The Operational Shift: More Reporting, More Structure, More Internal Controls

The Commission’s latest annual report also points to how the compliance machine is being industrialised, including quarterly reporting and publishing quarterly performance information from compliance assessments for the first time, increasing transparency and regularity.

For operators, that trend tends to translate into spend in four places:

1. People: compliance teams with specialisms (AML, safer gambling, marketing, data assurance).

2. Process: documented, testable playbooks for KYC/SoF, interaction triggers, marketing permissions, and incident management.

3. Technology: monitoring and case-management systems that can handle volume and complexity.

4. Assurance: independent audits, control testing, and governance that stands up to scrutiny.

Improvements Matter for UK Players (and the regulated market)

For consumers, professional compliance means fewer sharp edges: clearer protections, faster interventions when risk signals spike, and fewer marketing mistakes. For the market, it means legitimacy: the UK’s regulated ecosystem can remain attractive precisely because it is strict, and because operators can scale without standards collapsing.

In other words: the UK isn’t watching operators get pushed out. It’s watching them grow up.

Meet The Author

Experience

Most of my career was spent in teaching including at one of the UK’s top private schools. I left London in 2000 and set up home in Wales raising four beautiful children. I enrolled at University where I studied Photography and film and gained a Degree and subsequently a Masters Degree. In 2014 I helped launch a new local newspaper and managed to get front and back page as well as 6 filler pages on a weekly basis. I saw that journalism was changing and was a pioneer of hyperlocal news in Wales. In 2017 I started one of the first 24/7 free independent news sites for Wales. Having taken that to a successful business model I was keen for a new challenge. Joining the company is exciting for me especially as it is a new role in Europe. I am keen to establish myself and help others to do the same.

Read Full BioRelated News