How Much Have States Made From Online Casino Companies?

The popularity of online gambling has skyrocketed across the United States in recent years. However, there are only a few states that have legal online casinos. Each of these states’ economies benefits significantly from the taxes that these online casinos pay.

Many states have already legalized online sports betting and are now considering the natural next step of legalizing interactive gaming, i.e., a form of online casino gambling. As sports betting has been proven to boost states’ tax coffers it raises a new question that has to be asked.

How much money does the online casino industry actually make for states? Who benefits from that revenue? Casinos.com has analyzed the data over the past year and the answers are here.

State Revenue From Online Casino Companies

The states of Michigan, New Jersey, Pennsylvania, and West Virginia all have legal online casinos. The taxes collected are usually based on a flat rate applied to online casino companies’ revenue.

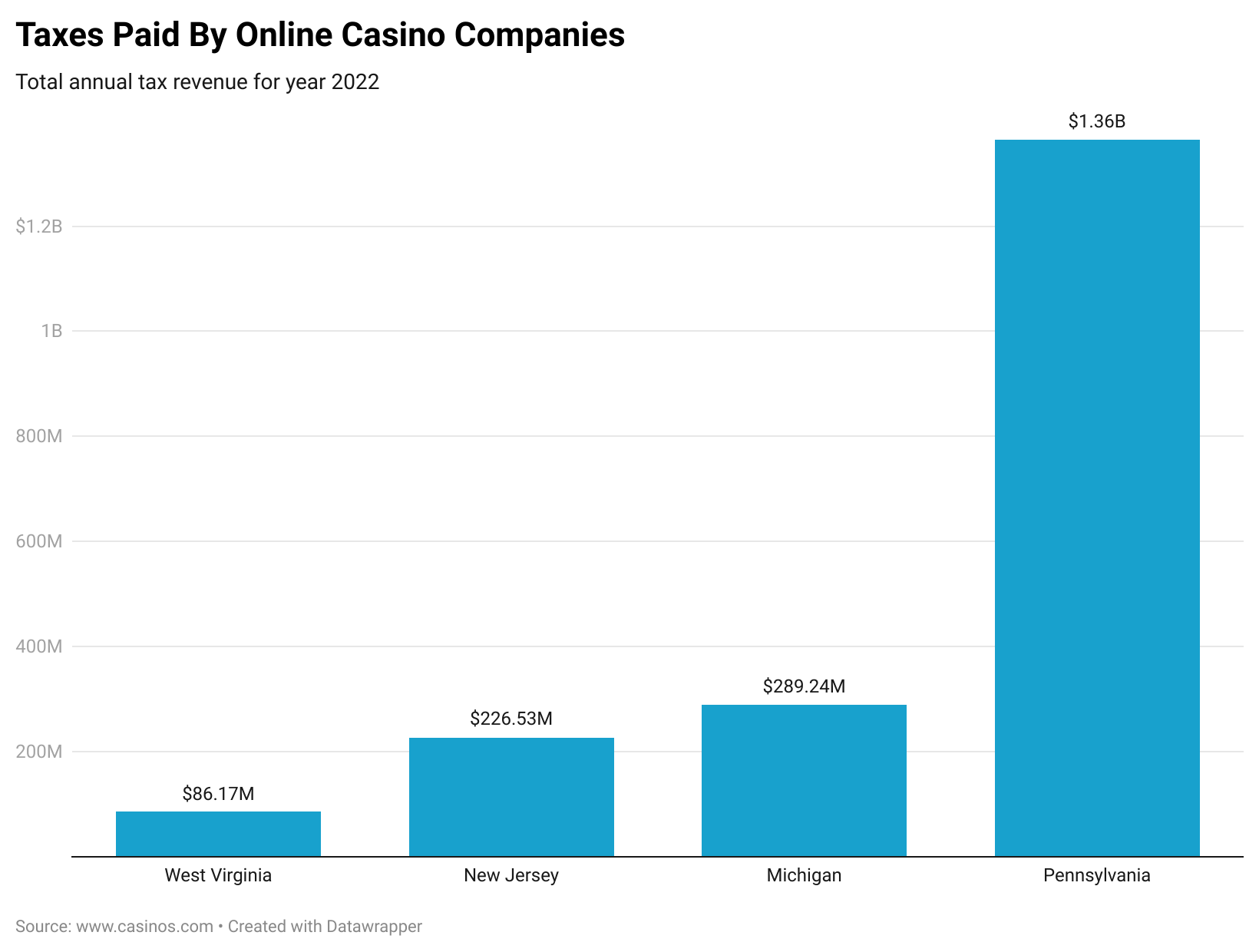

Taxes Paid By Online Casinos By State In 2022

| State | Total Tax |

| Michigan | $289,243,843 |

| New Jersey | $226,529,529 |

| Pennsylvania | $1,364,392,468 |

| West Virginia | $86,172,746 |

The state that earned the most from online casinos was Pennsylvania, bringing in over $1.3 billion for the year 2022.

Michigan

In total, all internet gaming operators paid $289,243,842.38 in taxes to the state of Michigan last year. The almost $290 million does not include the separate internet gaming state payments made by tribal casinos.

The tax on igaming varies from 20 to 28 percent based on yearly adjusted gross receipts totals.

New Jersey

Similar in numbers to Michigan, it was a good year for New Jersey where the state benefitted from tax payments of $226,529,529 from the eight casino companies that also offer igaming services.

The state requires companies to pay a 15 percent tax on internet gaming gross revenue.

Pennsylvania

The state of Pennsylvania was a standout in terms of tax collected, generating $1,364,392,468 in tax payments. This was an increase of over 20 percent compared to 2021 when tax revenue collected was $1,112,855,937. The only other gambling sector that made more was in-person slot machines.

West Virginia

The total tax collected by West Virginia from online casino companies for the year 2022 was $86,172,746.

A 15 percent tax is levied on West Virginian operators on their adjusted gross interactive wagering receipts. The current law only allows for a maximum of five interactive wagering licenses in the state in total. At any given time the licensees can partner with up to three gaming management service providers to run their online casinos.

Other States

Online casinos in Delaware are omitted due to the lack of competition and high taxation rates. The operators in Delaware are not incentivized to invest in online casinos due to the regulations surrounding the industry. For example, only desktop apps are available to Delaware players, while other states offer mobile apps. Currently, only one vendor can operate in the state, so there is no competition in the marketplace. In the future, this could change as the Delaware Lottery has asked for proposals for other vendors. Connecticut likewise only has two online casino apps operating under an effective monopoly.

Online Casino Tax Rate

What are the tax rates of the respective states where online casinos are currently legal? The state's overall tax system, its rules on online gambling, and its objectives for earning revenue from the sector can all affect the specific tax rate for online casinos.

- New Jersey: Online casino operators in New Jersey are subject to an 8% tax on gross gaming revenue.

- Pennsylvania: The tax rate for online casino games in Pennsylvania is 54% on gross gaming revenue.

- Michigan: Online casino operators in Michigan are taxed at a rate of 20-28% on gross gaming revenue, depending on the operator's annual adjusted gross receipts.

- West Virginia: Online casino operators in West Virginia are subject to a tax rate of 15% on online casino revenue.

Where Online Casino Money Goes In Each State

The presence of both online and offline casinos contributes significantly to job creation and tax revenue in the states where they operate. The generated funds support various community programs and public services while also addressing problem gambling and related harm.

One example is the tax allocation in West Virginia. In West Virginia, a portion of the tax revenue collected from online casino companies is allocated to the pension plan of employees working for licensed racing associations. The majority of the tax is directed to the State Lottery Fund, which supports various public initiatives and programs.

Monitoring the tax revenue generated by online casinos allows state governments to assess the industry's financial contribution and make informed decisions regarding regulations and policies. This data helps ensure the sustainability and responsible growth of the online gambling sector.

Online Sports Betting Revenue And Online Casino Revenue

While online gambling and casino revenue are both substantial, it is interesting to compare it with the revenue generated from sports betting in states where it is legalized. Analyzing the differences and similarities provides valuable insights into the potential market size and consumer preferences for different forms of online gaming.

There has been an increase in the pace of legalized online sports betting in the recent past. Most states have realized that bringing online gambling into the full protections of the law benefits their state's citizens as well as adds to their economies. Analysis of online sports betting revenue could hold key insights into how much a state can make from legalizing online casino or interactive gaming.

The Future Of Online Casino In The United States: Trends and Predictions

Looking ahead, several trends and predictions can be expected within the online gambling industry. These may include the introduction of new technologies, enhanced user experiences, the expansion of mobile gaming options, and the possibility of additional states legalizing online casinos. Staying informed about these trends can help industry stakeholders make informed decisions and adapt to changing market dynamics.

Methodology

All tax numbers are for the year 2022 and are collated from the state’s official governing body for online casino company monitoring.

Sources

- Michigan Gaming Control Board revenues and wagering tax information https://www.michigan.gov/mgcb/detroit-casinos/resources/revenues-and-wagering-tax-information

- New Jersey Division of Gaming Enforcement revenue reports https://www.njoag.gov/about/divisions-and-offices/division-of-gaming-enforcement-home/financial-and-statistical-information/

- Pennsylvania Gaming Control Board reports https://gamingcontrolboard.pa.gov

- West Virginia Lottery financial reports https://wvlottery.com/news-and-info/information/financial-reports/

Meet The Author

Experience

Fana is a writer and content specialist who specializes in the dynamic world of international publishing. For the past few years, her area of particular interest has been in the evolution of gaming laws due to her legal background. You can catch her sailing or swimming at the nearest beach when she's not keeping up with the most recent iGaming developments or honing her poker abilities.

Read Full Bio